Always the quest. – Ren, Prince of Octopon

If you grew up watching cartoons like I did, then you may remember this one from the 90’s called The Pirates of Dark Water.

The Pirates of Dark Water is an American fantasy animated television series produced by the dynamic animation team of Hanna-Barbera (The Flintstones, Scooby Doo) and created by David Kirschner, which first aired in 1991.

It was part of the Saturday morning cartoons line-up.

See my post on CBS Storybreak’s Yeh-Shen

Fun Fact: CBS Storybreak was also produced by Hanna-Barbera Productions.

A young man, seventeen-year-old Ren, learns that he is a Prince with an urgent quest to save his world by finding thirteen magical treasures of rule.

Ren is a very likeable hero much like Luke Skywalker. And for every yin there is a yang.

The pirate lord Bloth is a savage alien pirate and Ren’s mortal enemy. He is Ren’s Darth Vader.

The show had action, adventure, sword fights, and of course humor. This show was unlike many other of that time as it was way more serious, well-written, surprisingly mature, very developed with memorable characters, imaginative worlds, plot driven, and involved a high degree of morals. I still think of this show and those lessons to this day.

You get to go along with Ren and his shipmates, Tula and Ioz, on a quest to save the world. However, no cartoon by Hanna-Barbera would be complete if they didn’t give you some life lessons along the way.

The premise and the opening credits spoken over the theme music.

The alien world of Mer is being devoured by an evil substance known as Dark Water. Only Ren, a young prince, can stop it by finding the lost Thirteen Treasures of Rule. At his side, his allies on this quest are an unlikely, but loyal crew of misfits. At his back, is Bloth. The evil pirate lord, Bloth, will stop at nothing to get the treasures for himself.

I found the show synopsis at IMDB.com

Storyline

When Ren, a young son of a lighthouse keeper, rescues a stranger foundering in the rocks near his home, he learns the man was an aide to his true father, a great king. Ren is given a magic compass crystal that guides him to a dragon who shows him that the only way to claim his heritage is to find the Thirteen Treasures of Rule. Unfortunately, a pirate ship captained by the evil Bloth is also aware of this treasure and is relentlessly pursuing Ren for it. On his side, Ren soon acquires companions like Ioz the Pirate, Tula the Eco-Mage and Nibbler the Monkey Bird who help him in his quest. That quest becomes all the more urgent when Ren learns that the Dark Water, a carnivorous form of water that consumes anything it snares, threatens to envelope and destroy his world and only the treasures he seeks can stop it. Written by Kenneth Chisholm

The show’s opening credit ending theme song tagline: It’s high adventures with The Pirates of Dark Water.

Let’s go!

FORTUNE FAVORS THE BOLD

The rich are bold. So seek adventure.

Think Richard Branson, Steve Jobs, Oprah Winfrey or Walt Disney.

The characters in this series are also very outrageous, bold, and at times, reckless, but they get the job done.

This show is packed with great dialogue, fun characters, and on the edge of your seat action. The storyline was driven by its protagonist, Ren (voiced by George Newbern), the leader of this group of pirates. His unabashed furor over the treatment of people, eloquent way with words, and logical reasoning made him a good leader.

Accompanying him on his quest were Tula (voiced by Jodi Benson aka The Little Mermaid Ariel) and Ioz (voiced by Hector Elizondo of Pretty Woman, Runaway Bride). Ioz is a fortune hunter and mercenary swayed by Ren’s noble quest and throws himself in the fracas to help them. They also had a talking monkey-bird, if you can picture that, by the name of Niddler (who is also the comic relief).

For origins of the Little Mermaid see my post on Grimm

Wherever they go, trouble sure follows. Not surprisingly, as every successful person always has something or someone nipping at their heels, vying to claim the same victory to hang up on their mantelpiece.

Ren and company also receives help, guidance, and encouragement along the way. From this I learned that people are usually willing to help you, when you’re doing the right thing.

See my post Money and Life advice from Nike founder Phil Knight

SUCCESS TAKES TIME

There is nothing impossible to him who will try. – Alexander the Great

There is no shortcut on the road to success.

All things that are good and important take time.

You have to put the work in. Once you do that, then the money seems to follow.

In the show, Ren and his crew had to find the lost treasures of Rule and this takes time. After 21 episodes of the show, they still had only found seven treasures. And they had to guard them with their lives. This odyssey would no doubt take years.

Tula:

This is going to be a long trip…

You got that right!

Everyone was chasing those treasures. Kind of reminds me of the Legend of Zelda (which they also turned into a cartoon, as was the norm in the 80’s and 90’s).

If you remember that obscure animated series, then you know his famous line after he felt he should be rewarded by Zelda for keeping the Tri-force of Wisdom safe, “Well, excuuuuuse me princess.” Hilarious.

There is no story I have ever read that did not take the victor time to complete their journey to the finish line. Even Odysseus, didn’t make it home for ten years after leaving Troy and twenty after joining the Trojan war expedition, but that’s another story. If you like Greek mythology, then check out Homer’s the Iliad and the Odyssey.

Alexander the Great went on a military campaign for over a decade to conquer one of the largest empires in ancient times starting from 336 BC. William the Conqueror let nothing stand in his way to victory as the first Norman King of England, reigning from 1066 until his death. His conquest took six years. Don’t even get me started on The Crusades or Napoleon.

If you want something, then you have to be willing to put the time in.

When I decided I wanted to be financially independent, I studied hundreds of blog, reads dozens of books and started reading about conquerors of ancient civilizations and the self-made.

Over the course of seven years, I did the following:

- Went form saving $1 a day to $13,000 a year.

- Increased my savings rate by 2% or more per year.

- Calculated my FIRE number (Financial Independence/Retire Early) $750,000 and figured out a way to get there in less than 10 years.

- Started setting impossibly high SMART (Specific, Measureable, Attainable, Realistic, Timely) goals, tasks, and deadlines and meeting them.

- Figured out the date to retire my credit card debt (which is some of the worst you can have).

- Determined that all credit card debt is the worst kind of debt to have and found a way to get rid of all revolving debt.

- Reading a minimum of 2 books a month.

- Established a six-figure retirement.

- Started saving $15,000 a year in 2019.

That took years! However, as you can see from above, patience, hard work and determination get results. This blog takes you along on my quest and all the things I do in the pursuit of financial independence. And ultimately, earn back my freedom as time is one thing you can never get back once it’s gone.

FRIENDSHIP IS IMPORTANT

Remember upon the conduct of each depends the fate of all. – Alexander the Great

One of my favorite things about this show was the kinship of not only the show’s stars, but the people in that world. They were always willing to lend a hand to help one another. Especially, in those dark times, people just banded together. As it should be. They also forgave.

Lend me some sugar, I am your neighbor! – Outcast, Hey Ya!

Treat your friends as if they are worth their weight in gold. The ones that truly have your back will be there in good times or bad.

Lots of people want to ride with you in the limo, but what you want is someone who will take the bus with you when the limo breaks down. – Oprah Winfrey

Got it?

Good.

RESPECT

It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently. – Warren Buffet

Everywhere Ren went he received respect whenever he name dropped his father’s name, King Primus. It was awesome to see people help him because of the reputation built by his father. Wow.

That taught me reputation is everything.

Keep a good name. Keep your promises. Overcommit and over deliver.

You want respect? You have to earn it.

I like to write. And it’s exciting to write new content. I try to keep this blog informative, but fun. It’s like Sesame Street for adults! Ha ha!

So, if anyone ever namechecks Greenbacks Magnet, I know it’s because they like what you read.

MONEY ISN’T EVERYTHING

Havin’ money’s not everything, not havin’ it is. – Kanye West, Good Life

The show is constantly filled with pirates talking, stealing, earning, or wanting gold and treasure. It’s all in good fun. However, there are times when Ren and his friends are in grave mortal danger. His companions mean the world to him. The circle of trust is very strong and real with them. They never leave one another behind. Not ever.

Ren never chooses money, things, or any possession over people. A fine quality to have indeed.

You can get more things, you can earn more money, but there is only one You! Never forget that.

BEING EVIL ALWAYS MEANS LOSING SOMETHING

50 told me, go ‘head, switch the style up. And if they hate then let ’em hate and watch the money pile up. – Kanye West, Good Life

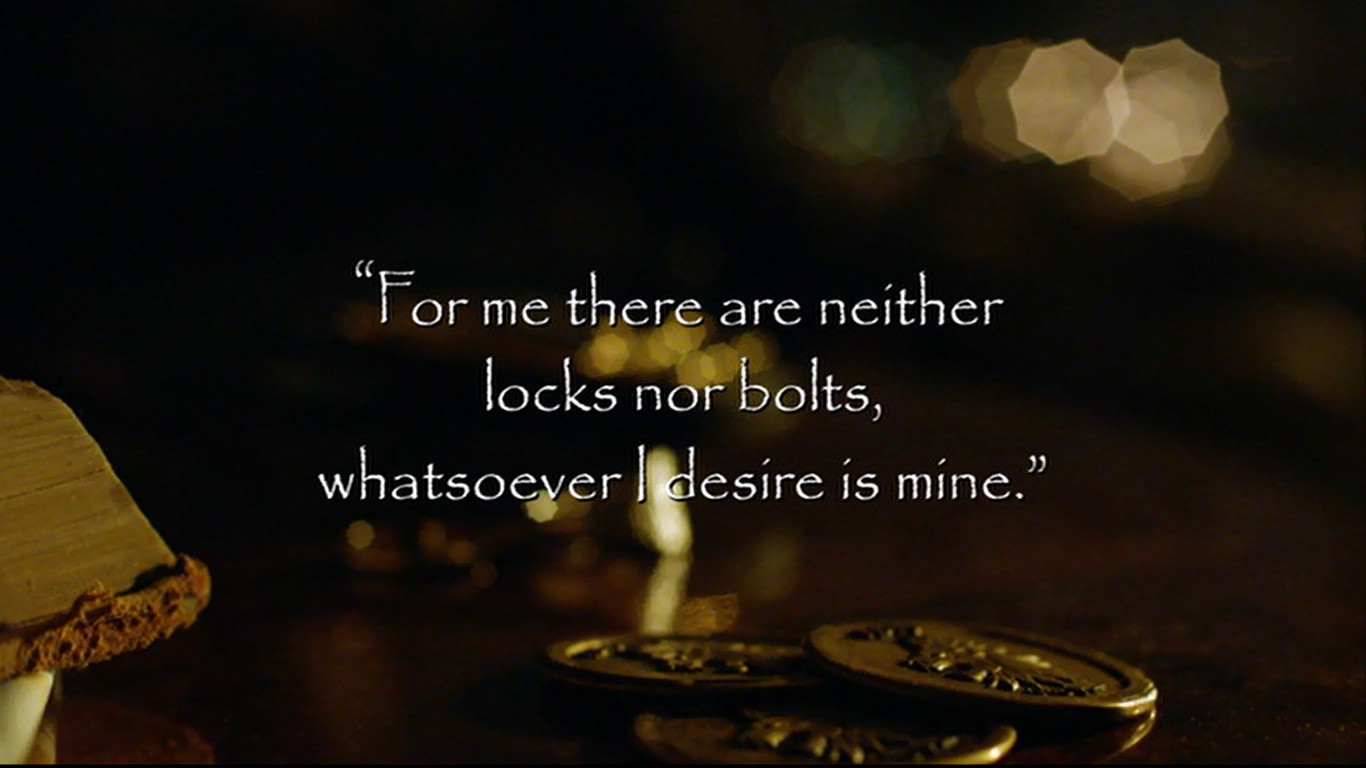

On the show, the pirate lord Bloth was always trying to lie, cheat, steal, and con his way in and out of everything. His ego could suck up all the air in a room. However, Ren and company always thwarted him in the end, to his chagrin.

Here is some dialogue from the show.

Onda, The Dagron Master:

What about my gold? You promised!

Ioz:

A pirate’s promise. I lied.

ETHOS, PATHOS, AND COMPASSION

The protagonist, Ren, is kind to everyone. He is also loyal to a fault. Therefore, he values honesty and loyalty. And this becomes his reputation. His good natured ways and good name takes him far in the world.

The sheer amount of emotion he evokes and passion for what he does is inspiring. He acts without malice, but steadfastly and with courage. Ren also takes the advice of those he trusts most and not just anyone.

Here is some more dialogue from the show.

Ren:

I can’t ask you to continue with me on this dangerous quest. Name the port of your choice and I’ll take you there.

Ioz:

Which way does the compass point?

Ren:

[Ren picks up the compass and spins it around] The second treasure of Rule… East!

Tula:

Then east it is! For adventure!

Ioz:

For treasure!

Ren:

For Octopon!

Niddler:

For crying out loud! When are we gonna eat?

They would throw in some humor once in a while as you can see.

I have also learned to take good advice when it’s given.

It’s not about the messenger, it’s the message.

One of my favorite episodes on the show as entitled, “The Beast and the Bell,” episode 8, which aired on November 2, 1991.

Ren is tricked into freeing an imprisoned evil creature by the name of Keroptus.

He makes a promise to re-imprison the monster to the people who guard him. I will never forget what he said to an optimistic Ren about this dangerous foe as you should never underestimate an enemy.

King of the Guards:

Keroptus is nobody’s fool boy. He will not be easily deceived by parlor tricks.

To this day, I feel that way about every person I meet. You do not know what or who anyone knows. You should always proceed with caution.

Well, that concludes this latest post.

I enjoyed revisiting this show from my childhood.

It always gives me a great feeling when I watch this show. The swashbuckling, seeking of treasure and adventure. Personally, that’s how it feels to pursue wealth. I go for the gold. And I play to win.

I know a credit card company has a saying; don’t leave home without it. However, this show taught me how valuable having morals are and I learned to never leave home without them.