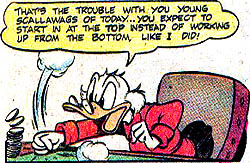

There is always another rainbow. – Scrooge McDuck

The IRS has updated the new contribution limits for retirement plans. The annual limit on elective deferrals will increase to $23,500 (up from $23,000) for 401(k), 403(b), and 457 plans, as well as SARSEPs, and to $16,500 (up from $16,000) for most SIMPLE plans and SIMPLE IRAs.

That’s great news!

If you can max out your 401(k) with a 10% return, you would have $1M in 17 years. It would only take you an additional six years to get to the next million. You would then be a multimillionaire.

I know what you’re thinking.

How on earth am I going to get to one million let alone two million.

Just hear me out.

Let’s talk about how you can start with nothing and end a millionaire.

I will take you through the origins of a pension and ending with the rise in the 401(k).

Think of it like a roller coaster ride.

Deciding to strap in your seatbelt is the hardest part. It’s getting down the first hill that scares us and then after that it’s pretty much smooth sailing.

What is a pension? A pension plan is a retirement plan that provides a regular income to an employee after they retire. The employer is responsible for managing the investments in the plan and bears the risk of market decline.

Pensions have been around for a long time, with origins dating back to the classical world and before the United States was founded. The first military pensions were adopted in the United States, and the first veterans’ pension was offered to retired naval officers in 1799.

In 1875, the American Express Company established the first private pension plan in the United States, and, shortly thereafter, utilities, banking and manufacturing companies also began to provide pensions.

However, pensions go back even further. All the way to ancient times.

In the Roman Empire, veteran legionnaires received military pensions in the form of land grants or special appointments. This sort of barter system was still going around 50 B.C., when Roman soldiers were paid in salt, a highly valued commodity at the time.

Even the word salary comes from ancient times. The word “salary” comes from the Latin word salarium, which means “salt money. In ancient Rome, soldiers were paid in salt, a valuable commodity used to preserve food. The Latin word sal means “salt”. The word salarium continued to be used to refer to soldiers’ pay even after other forms of payment were introduced.

The word salarium entered the French language as salaire, and then into English in the late 13th century as salarie. The Norman conquest in 1066 introduced many Latin-derived words into the English language, including “salary.” That was during the time of William the Conqueror, but that is another story.

Have you ever heard the saying about being “worth your salt”? Now you know where it came from.

And just in case you were wondering, no, Social Security is not the same as a pension. That is a social insurance program started by Franklin Roosevelt (FDR) in 1935. Social Security is a social insurance plan that is intended to supplement a retired worker’s pension and savings.

Social Security is an earned government benefit for seniors, people with disabilities and children who have lost a working parent. Working people contribute to Social Security with every paycheck. A pension is income you set aside while you’re working so you will be able to get a monthly paycheck when you retire. Pensions have vesting periods and Social Security does not.

Pensions became popular after the Second World War in the 1940’s and through 1970 when as many as 52% of workers had them. Employers managed the program, but they also took on the administrative cost burden and risk associated with them. Then, sadly, pensions started going the way of the dinosaur and Atari game console.

The 401(k) is the PlayStation 5 of our day and bumped out the pension, which is the Nintendo of days past.

Today, about 10% of private employers offer pensions. This started being replaced by the 401(k).

One of the biggest silver linings of having a 401(k) versus a pension is the fact that a 401(k) cannot go bankrupt. However, a company can and once that happens they are under no obligation to pay pension benefits; whereas, your 401(k) travels with you wherever you go like a passport.

A silver lining is a positive aspect or sign of hope in a situation that might otherwise be negative. It’s often used in the proverb “every cloud has a silver lining,” which means that there’s always something good or hopeful to be found in even the worst situations.

Now, that you know more of the history of pensions, let me show you how you can start with nothing and rise to the top just like Jennifer Lawrence in the Silver Linings Playbook. She may be a top paid leading lady in Hollywood now but as a broke teenager starting out, she had nothing.

Actress Jennifer Lawrence at the Red Sparrow premiere in New York on February 26, 2018. REUTERS/Caitlin Ochs

She grew up in Kentucky in a middle-class family and had a middle-class upbringing. Growing up she often felt like a misfit as she did not fit in with her peers.

I can relate to that on some level as I was always striving to get the gold star on the behavior chart every day at school. I was less impressed with class clowns, popular kids or jocks and more focused on reading and getting into college. My parents called me the rebel of my four siblings. I didn’t care. I know I was meant for something else. I wanted to be a writer and a rich businesswoman. Just like Jennifer, I was charting my own path.

After a talent scout spotted 14-year-old Jennifer while on vacation, she told her parents she wanted to pursue acting. She then worked on leaving school and got her GED so that she could start auditing for parts.

She actually audited for the role of It-girl, Serena van der Woodsen, in Gossip Girl, but lost the part to Blake Lively. She has said she was really bummed not to get the part. However, as one door closes, another opens.

She got her first paid role in 2006 and a small part as a mascot in an episode of Monk. However, the movie that got her the buzz she needed to get cast in bigger films was when she got cast for the leading role in Winter’s Bone. Lawrence’s acting amazed critics and audiences alike. I saw the film and I knew instantly that a star was born.

At only 20-years-old, she earned an Oscar nomination for Best Actress in a Leading Role. And from there, Lawrence’s success continued to skyrocket.

In 2011, she landed the role of Mystique in Marvel’s X-Men: First Class.

In 2012, she wowed audiences as Katniss Everdeen in The Hunger Games. The post-apocalyptic, dystopian film was an instant hit. This is the film where she earned her first $1M paycheck. The first women to ever get that million was none other than Elizabeth Taylor for the 1964 film Cleopatra. Jennifer was in good company.

Later in 2012, Lawrence starred in another successful film, Silver Linings Playbook. She won an Oscar for Best Actress for her performance. And at the time, she was the second-youngest actress to achieve this honor. Lawrence was only 22.

If you think her rise to superstardom was fast, then think again. She doesn’t owe any of her success to luck. She worked hard for her multimillion-dollar salary.

In Jennifer Lawrence’s own words: “I put in my time; I lived in a rat-infested apartment when I was 14, and I was told ‘No’ many times. I put my blood, sweat, and tears into all of this. It’s easy to look from the outside and see my career grew very fast, but there was a time before that career when I was working for it. And I definitely wouldn’t have wanted that time to go on any longer.” I feel her on that.

I lived in small apartments, ate ramen for dinner and had times that I lived off of $5 a day. It was only after I put in my time that I was able to negotiate a six-figure compensation package later in my career and started investing upwards to $10,000+ per year, that I started to see some return on my own sweat and tears.

Here is a peak behind Jennifer Lawrence’s financial playbook:

Here’s how she made from playing Katniss and Mystique in these franchises:

- The first Hunger Games installment paid her $1 million. She earned $10 million for the second film and $20 million apiece for the third and fourth movies.

- As Mystique in the X-Men franchise, Lawrence earned $250,000 for First Class, $6 million for Days of Future Past, $8 million for Apocalypse, and $4.7 for Dark Phoenix.

On average, Jennifer Lawrence earns between $15-$20 million per movie. Her paychecks for a few of her films were:

Passengers (2014): $20 million

Don’t Look Up (2021) $25 million

Red Sparrow (2018): $20 million

Jennifer also has other sources of income such as endorsement deals.

In 2012, she became the face of Dior. The luxury brand paid the actress a cool $20 million.

She owns a production company.

She is also a landlord. owns a luxury apartment in Manhattan. She paid $9 million for the unit and now rents it for around $27,000 monthly.

What I have learned from her story is that you have to create opportunities for yourself by showing up and doing the work. Success is not just going to fall into your lap. You have to go get it. Success not only attracts success, but it also leaves clues.

In order to earn her first million, Jennifer Lawrence had to act in numerous plays, move to New York, get an agent, audition for dozens of film and television roles, learn how to become an archer, sit in a makeup chair for 3-6 hours to be painted blue everyday on set for weeks and months and work out 1.5 hours a day for months on end over about a decade time period. Nothing happened by accident. It was intentional.

You must use your 401(k) in the same manner.

I waitressed, was a phone operator, a gas station attendant, scrubbed toilets, working all the while earning a bachelor’s and Master’s degree, read about 15 personal finance books a year, started a blog and was promoted numerous times at different companies to get to where I am today.

My first million is so close I can feel it tapping me on the shoulder.

When Business Insider did my story, I was at $375,000 in investable assets. I have since seen had my investments grow to $422,000. My $500,000 journey is rapidly coming to an end. Compound interest is barreling me toward the finish line. Depending on market fluctuations, I will hit my target of $500,000 in 365-500 days.

A company going bankrupt cannot blow up my retirement. My pension cannot be taken away from me the same way Lucy takes away that football from Charlie Brown. My 401(k) is mine forever. Just let that silver lining sink in.

About The Author

Miriam started Greenbacks Magnet in 2016 to keep a scorecard of her goal of $1M in investable assets. Armed with a Master in Management (MiM) and a calculator, she teaches readers how to achieve financial independence while also helping them learn how to smell the roses along the way. The palpable response she got from sharing her personal finance goal in a public speaking course at Georgetown University encouraged her to share her story and teach finance on her website. She invests in AI companies as artificial intelligence is the new iPhone of the moment as she likes to invest in companies that are disruptive.