`Curiouser and curiouser!’ cried Alice – Alice in Wonderland by Lewis Carroll

My sentiments exactly Alice! As I watched the Suze Orman show trying to learn about personal finance, that is exactly what I thought to myself.

What is this strange new world called financial freedom? The more I watched her show, the more I wanted it.

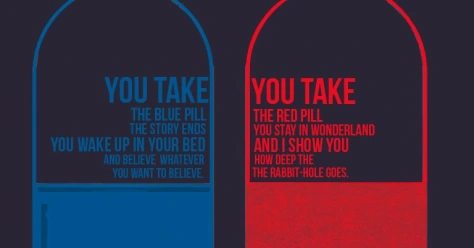

Essentially, do I take the blue pill or the red pill?

As the title of this post implies, I took the red pill.

Financial Independence. I wanted the ability to do what I wanted, whenever I wanted without being tied down to a 9-to-5. But how would I do it? I needed a plan.

Much like the Scooby gang needed a Scooby trap, I was going to have to plan my way out of the rat race and into financial freedom. A financial road map. That’s what I needed.

![Official Discussion Series] Scooby-Doo on Zombie Island (Oct. 31) : r/Scoobydoo](https://i0.wp.com/25.media.tumblr.com/ae2c58b4995b416b6a974ccc9e8c8c90/tumblr_muhvr25eL61qgjo5ao8_250.gif?resize=474%2C339&ssl=1)

It was like what Gail Vaz-Oxlade of Til Debt Do Us Part would always say in the intro of her show, I needed to go from red to black. My investment picture of over more than a decade is listed below.

Here’s a sneak peak behind Greenbacks Magnet financial magic curtain. Up first, from red. Then fade to black. Or in my blogs case, green.

Financial chaos bleeds. Here’s the red.

- Oct, 2023: -$16,000 (market + house value ↓ )

- Sep, 2022: -$22,000 (market crash + loss of 2nd income)

- Sep, 2021: -$15,000 (market crash)

- Apr, 2020: -$20,000 (market crash continues + pandemic)

- Feb, 2020: -$19,000 (market crash; where the bleeding really starts)

- May, 2019: -$10,000 (market crash)

- Dec, 2018: -$14,000 (market crash)

- Oct, 2018: -$10,000 (market crash)

- Feb 2018: -$4,900 (market crash)

- Jan, 2016: -$4,000 (market crash)

- Aug, 2015: -$5,000 (market crash)

- Jun, 2013: -$4,000 (market crash)

- Sept, 2012: -$14,000 (market crash + cash crash + got a new home!)

- Feb, 2010 -$1,000 (market crash + got a new job!)

- May 2009: -$3,000 (market crash + laid off)

Financial triage has prevailed. Here’s the black.

- Nov, 2023: +$27,000 (market rebound + 2nd job + house value ⬆)

- Oct, 2022: +$17,000 (market up + mad hustlin’ 2nd job)

- Mar, 2022: +18,000 (market up + bought condo)

- May, 2020: +27,000 (market rebound; the green starts rollin’ in)

- Jun, 2019: +$9,800 (market rebound)

- Jan, 2019: +$10,000 (market rebound)

- Aug, 2018: +$6,300 (market up)

- Feb, 2017: +3,900 (market rebound)

- Mar, 2016: +$5,000 (market rebound + tax refund)

- Oct, 2015: +$6,000 (market rebound)

- Feb, 2015: +3,300 (market up)

- Aug, 2014: +$2,000 (market up)

- Jun, 2010: : +$4,000 (market rebound)

- May 2008: +$2,000 (market up)

- Dec, 2006: +$1,000 (got a new job!)

First, I got rid of any payday loans and made a promise to myself to not ever sign up for them or any car title loans. Done.

Second, I needed tp pay off my car loan and stay away from car payments. So I paid off my SUV and freed up that monthly payment of $448.65 in 2009. I have not had a car payment since. Done.

I needed to get rid of the $20,000 personal loan I took out for $333 monthly. Done.

I needed to increase my income. So I finished my bachelor’s and got a higher paying job. Done.

I needed a goal to aim for. I decided upon one short-term and one long-term and one sensational dream goal.

Short-term I needed a $10,000 savings emergency fund. Done.

Long-term I wanted to retire a multi-millionaire. So I needed at least $2 million. Sensational dream goal is $10 million. I decided to break this all up into smaller goals. Therefore, I would start by having investable assets of $100,000. Done.

Then $250,000. Done.

Next was $300,000. Done.

Although, having over a quarter of a million-dollars is an incredible feat in itself, I had no time to rest on my laurels. I must keep going.

Then I started to press on toward my next goal of $500,000. After that is accomplished, I will set my sights on $750,000. The next leg in the journey would be $1 million.

At that point, I would be a 401k millionaire.

The next goal is to double my money. I would get to my next several money milestones by increasing my 401k contributions by 1-2% every year.

No vacations unless they were paid for with cash.

I also got a second job to bring in more income.

I signed up for credit card and checking account bonus offers that brought in thousands.

I invested my old car payments in index funds like the VTSAX and individual stocks like Apple, Google and Amazon.

And every time I got paid I would put a small portion in my Roth IRA.

I also make sure to keep track of my investments every month.

I’ll breakdown more of my behavior on how I went from $0 to over $300,000 in my next post.

Stay tuned…

I do not even know how I ended up here, but I thought this post was great. I do not know who you are but certainly you’re going to a famous blogger if you are not already 😉 Cheers!

Hey there! I’m at work browsing your blog from my new apple iphone! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the excellent work!

Thank you so much! You are too kind. I try!

xoxo Greenbacks Magnet